- The Hill Meets Households

- Posts

- The Coming Commerical Real Estate Crisis

The Coming Commerical Real Estate Crisis

Landlords and Lenders are on the hot seat.

Over the past few weeks/months there have been rumblings on a few news outlets and small segments (on TV/Radio) covering an upcoming commercial real estate crisis. This hasn’t been fully picked up by major outlets because the full effects haven’t been felt yet, but it’s an issue worth knowing about.

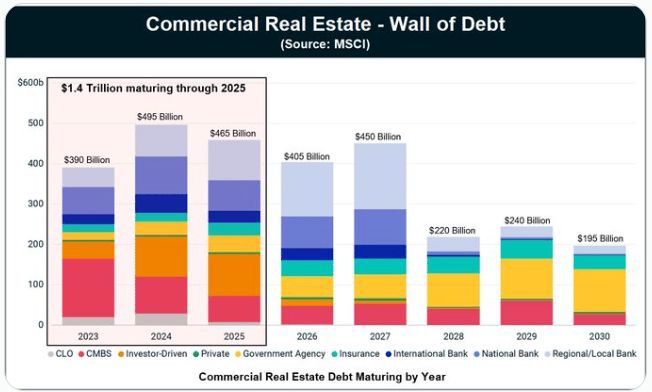

The commercial real estate crisis started gaining momentum when people started looking into bank investment exposure when banks were collapsing earlier this year. People realized there was a $1.4 trillion wall of commercial debt in commercial properties like office space and retail (both of which have struggled since the pandemic in 2020) due in the next few years.

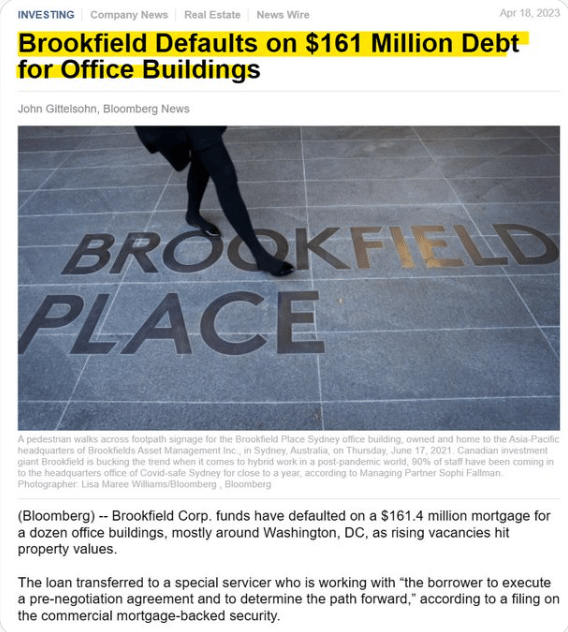

We're already seeing owners of office buildings, malls, and apartments "walk away" from their properties.

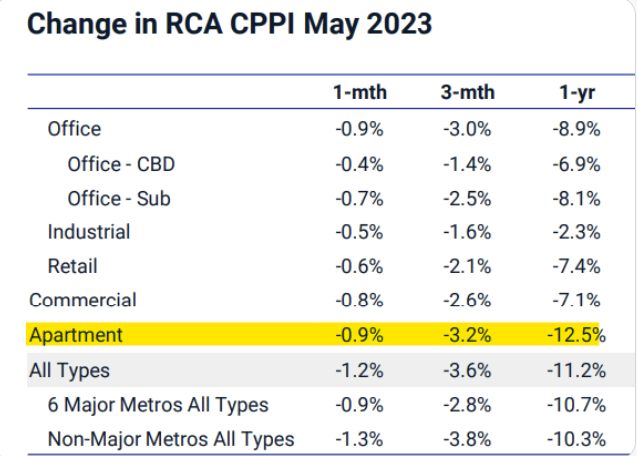

Office buildings are going to get hit especially hard, because work-from-home has lowered occupancy rates. At the same time, interest rates have doubled over the last few years, meaning owners who need to refinance are now losing money on their property. But this crisis isn’t just office buildings. Apartments are also getting hit hard, with values down -12.5% over the last year (the highest of any commercial asset class).

The Bigger Issue.

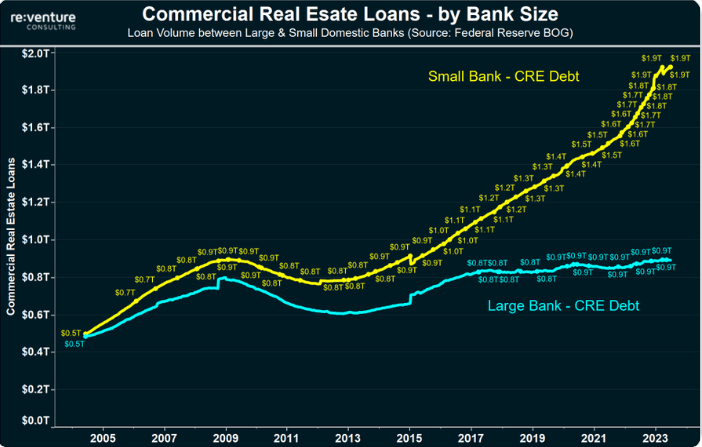

Low occupancy rates and businesses walking away from buildings is an issue, but the bigger issue is with the banks holding the debt of these properties. Small banks hold a massive $1.9 trillion in CRE debt in 2023 (way more than large banks).

Small banks hold so many commercial real estate loans that they account for 37% of their deposit base ($1.9 Trillion CRE Loans / $5.2 trillion Deposits).

What does this mean moving forward?

If you deposited your money with a small, regional bank over the last several years, they loaned it out. They likely loaned it to owners of office buildings, apartments, and retail centers who are now beginning to default on those loans. This could potentially cause a credit crunch in 2024, where banks are forced to cut back lending. A credit crunch could cause a recession/job loss and further, more bank failures and defaults. For comparison, back in 2007, there were $1.3 trillion subprime loans in the US. That brought down the banking system & economy. Meanwhile, banks hold $2.9 trillion in CRE loans today (with trillions more in CRE debt floating around in CMBS and private issuances). This is not a good situation.

The best-case scenario moving forward is a Fed Pivot where interest rates come down helping take some of the pressure off banks.

Follow us on Twitter @Freedomville_ for more day-to-day coverage.

Email us questions or reactions @[email protected]