- The Hill Meets Households

- Posts

- The Current Health of the US Labor Market

The Current Health of the US Labor Market

Where its headed and why it's not as great as it seems.

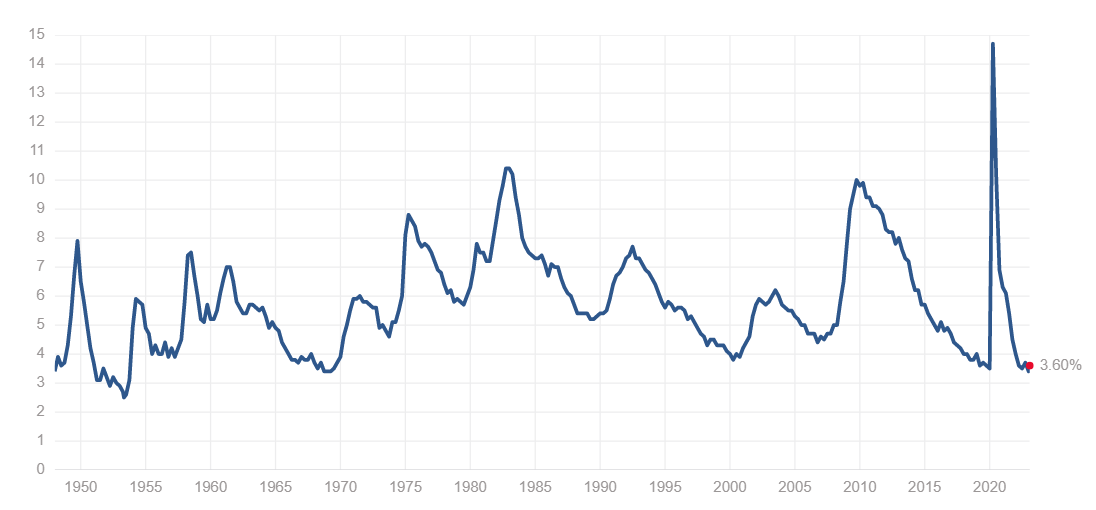

The US job market and unemployment rate have been at record lows for quite a while now. The March jobs report (which came out 2 weeks ago) reported the unemployment rate dropped from 3.6% to 3.5% the previous month. This is an impressive number and a statistic the Biden Administration has been boasting about for the past few months. Below is a historical unemployment rate chart up to February 2023 (3.6%).

This unemployment number is impressive and should be joined by strong economic growth, similar to what we were seeing pre-pandemic. However, that is not the case. When you take this 3.5% unemployment rate and put it into context with the work force participation rate, it tells a different story. The work force participation rate measures the percentage of the working-age population that is either employed or actively looking for a job. The current work force participation rate is 62.6%, down from the pre-pandemic level of 63.3%. This might not seem like a lot, but .1% roughly equates to 500k-600k workers. This means roughly 3.5 million workers have yet to return to the work force.

When you apply the labor participation rate to the unemployment rate you realize the unemployment rate is artificially lower than normal because there are less workers. Less workers makes it easier to have a lower unemployment rate because the unemployment calculation includes less people in total. This is the necessary context needed to truly evaluate the labor market; however, the mainstream media doesn’t report this.

The current labor market (first quarter 2023).

I would be lying if I said the labor market on paper isn’t in a solid place. Employers in March added 236k jobs, which was on pace with estimates. Leisure and hospitality led the job gains last month, with payrolls growing by $72,000. The bulk of that increase stemmed from hiring at restaurants and bars, which added 50,300 workers in March. Other notable job gains took place in government (47,000), professional and business services (39,000) and health care (33,900). Retail shed 14,600 jobs.

The direction of the labor market.

Unfortunately, even with a solid first quarter (and 2022) there are some signs of the labor market starting to cool off. In a different jobs report (reported around the same time), the number of available jobs decreased for the first time since May of 2021. This isn’t anything major, but it could be a sign of things starting to cool. Interest rates also play a role in the labor market. When the federal reserve hikes interest rates, this tends to create higher rates on consumer and business loans, which slows the economy by forcing employers to cut back on spending. The first thing companies tend to cut in these situations are jobs. Recently the tech industry has been getting crushed by layoffs. Upwards of 10% of the entire industry has been laid off in the past year.

It’s not just tech that is starting to feel the pinch. The below layoffs have happened in the past month in a wide variety of industries.

EY (one of the big accounting 4s) recently cut 5% of its work force.

Disney is rumored to be cutting 7k jobs later this month.

Walmart and Best Buy have been cutting upwards of 700 retail jobs in the past month.

J-Crew cut 3% of its New York work force.

Indeed cut 15% of its work force last month.

Tyson Foods cut 1700 workers in its mid-west region.

BuzzFeed is cutting 15% of its work force.

Moving forward.

In the Fed’s last meeting, Jerome Powell (the Chairman of the Fed) stated that they were pleased with the labor numbers and the report added support to another rate hike in May. If the Fed continues to raise interest rates, it’s not a matter of if the job market will be affected but rather a matter of when.

Follow us on Twitter @Hill_Households and @Freedomville_ for more day-to-day coverage.

Email us questions or reactions @[email protected]