- The Hill Meets Households

- Posts

- Silicon Valley Bank: The Safest Place to Keep Your Money - As of Monday

Silicon Valley Bank: The Safest Place to Keep Your Money - As of Monday

SVB, The Government, and the Current Status of the Economy

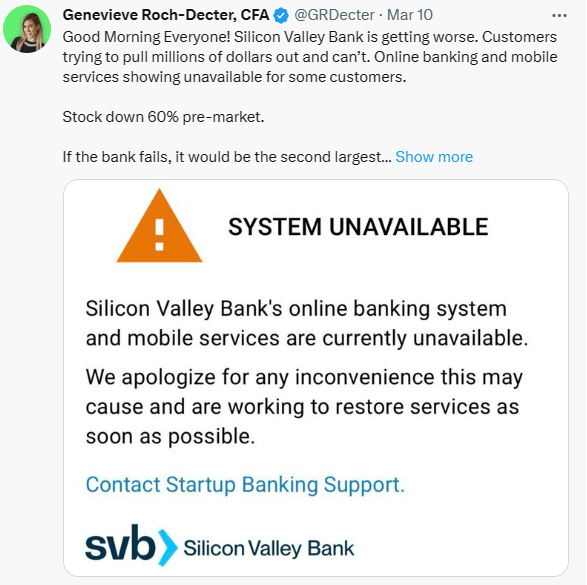

Last week, SVB couldn’t produce some of its depositor’s money after taking a massive loss in its bond and mortgage-backed securities portfolio because of rising interest rates.

Once word got out about the default, SVB effectively collapsed causing a massive ripple effect throughout the economy and banking industry. Depositors with money over the FDIC 250k limit saw their money disappear overnight.

In order to prevent further panic from depositors (in other healthy banks), the government stepped in and backed 100% of depositor’s funds in SVB regardless the of the FDIC 250k limit.

Government Gaslighting

By guaranteeing depositors funds, the government is now taking on the loss SVB incurred. In order to pay the depositors back (or keep the value they had), the government will have to come up with the lost money. Biden and the FDIC insisted on Monday that none of the money would be coming from the taxpayers, and this is should not be considered a government bailout.

This is a lie.

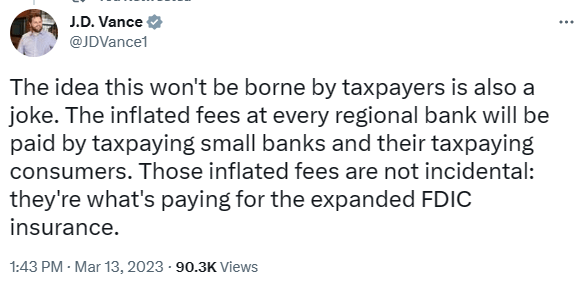

The Biden administration and FDIC stated this money would be coming from The Deposit Insurance Fund. This fund is funded by fees that banks have to pay to the government. Banks (being a business) passed these fees along to customers in forms of higher banking fees and costs in order to maintain profitability.

The idea that this isn’t a bailout is just simply gaslighting.

Taxpayers paying the bill isn’t the only major problem with government bailout…

Government “Protection”

As of Monday March 13th, Silicon Valley Bank (SVB) became the safest place for anyone in the entire world to keep their money even after its collapse over the weekend.

You might be asking yourself “How is this possible”? Well, since the total funds are 100% government backed there’s no longer a risk of losing it. However, if your money is in a healthy bank like BofA, Chase, PNC, etc. it’s at risk since it’s only insured up to 250k.

This caused a bit of an issue for the Biden Administration.

If another bank goes down, is the government going to back those depositors fully? It sure seems like it.

Nationalizing the Banking System

By defacto guaranteeing all depositor funds in the US banking system, the Biden administration nationalized the entire banking system in one weekend without Congress or any other governing bodies. This idea raises a lot of concerning questions:

Will the Fed insure the entire banking system all 17.6 trillion?

Will the Fed take on the loses of other banks?

Can banks make loans without consequence now?

If the answer to any of these questions is yes, then we’ve lost the free market American banking system. This might seem extreme, but the jumps we made in this newsletter aren’t that far apart.

Inflation

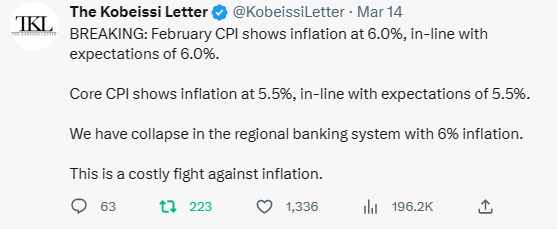

On Tuesday the February inflation number came out at 6%, meeting expectations. This number should buy the Fed some time make a decision on the next rate hike. A higher number would have forced them to raise rates again, potentially putting more banks and institutions at risk.

Follow us on Twitter @Hills_Households or @Gaslighting_101