- The Hill Meets Households

- Posts

- The United States is Spending Itself into Destruction.

The United States is Spending Itself into Destruction.

How government deficit spending is leading us down the wrong path.

The United States has had a spending problem for 20+ years now and it’s only getting worse. Earlier this week, Fox Business released an article highlighting the spending deficits the government is facing in 2023.

The article states that government spending is up 13% on the year while revenues are down 3%, putting us on pace for a $2 trillion deficit this year. Higher interest payments, social security, and Medicare are all main drivers of higher deficits this year. Congress (and the President) are supposed to be working on a budget for 2024. For the budget, the GOP has expressed that they are looking for ways to cut spending while the President is more concerned about raising taxes.

What is the current national debt?

To put this in perspective, that’s $94,600 per person or $246,900 per taxpayer.

Government spending vs our country’s purchasing power.

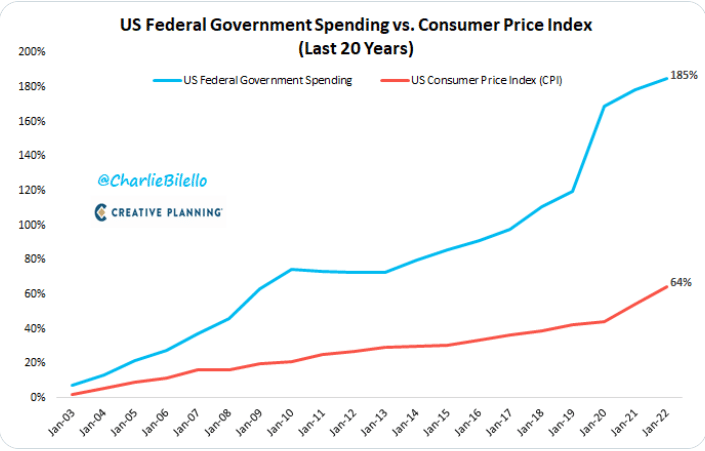

Over the last 20 years, Government spending has increased 185% versus a 64% increase in overall inflation (CPI). A 185% increase is annualized to a 5.5% increase per year, which is more than double the annualized increase in CPI (2.5%).

This means our spending is out pacing our overall economic price level by more than double. The graph above clearly documents how this has exacerbated year over year.

The US debt course - next 10 years.

If the US doesn’t change its debt course, it’s going to add $20 trillion (of debt) in the next 10 years. The debt to GDP ratio will go from 98% to 118%. With that said, the debt payments (interest payments) on the debt are going to jump to $1.4 trillion a year (yes, a year). The government currently brings in approximately $3-4 trillion in taxes a year. This means roughly 20-25% of our tax dollars will be spent on interest payments. To make matters worse, the long-term projections (exceeding 10 years) show an almost complete loss of control over fiscal policy with debt rising sharply upward. In other words, the collapse of the United States Dollar (USD) and the United States Government.

Outside looking in.

I recently wrote a newsletter about The Attack on the US Dollar (beehiiv.com). If you read through it and were contemplating why countries would stop using the USD as the world’s reserve currency, the paragraph above might give you some clarity. Countries are fearful of the fiscal path America is on. Here is a video of the President of Kenyan recommending his country to stop using the dollar.

President William Ruto has put on notice traders hoarding the US Dollar.

#TheGreatKBC

— KBC Channel1 News (@KBCChannel1)

3:45 AM • Mar 23, 2023

Solution.

The best way for us to fix this problem is to stop spending money (obviously). We are going to need someone to come in and cut a lot of costs. Upwards of 30% cuts are necessary to fix this. Next, we need to implement a balanced budget amendment that forces congress to operate on a balanced budget. This way we don’t have certain administrations spending boat loads of money and then leaving it for other administrations to clean up. We also need to start bringing productivity (jobs) home. This will help us raise government revenues (through taxes) and also raise GDP. These three things together can change the course we’re currently on and prevent this from happening again in the future.

Follow us on Twitter @Hill_Households and @Freedomville_ for more day-to-day coverage.

Email us questions or reactions @[email protected]